INTRODUCTION

You may have already have read two books that have recently been high on the non-fiction best sellers

lists. Sapiens and Homo Deus by Professor Yuval Noah

Harari are an original take about what ignited the big bang of creativity that occurred in our species about 40 - 60 thousand

years ago.

Professor

Harari postulates that the emergence of shared beliefs and religion were amongst the key factors that enabled otherwise isolated communities of Sapiens to act in unison and to work together to build civilisations and wage war against collective threats. Our species ability to have collective beliefs that extended beyond family and tribal boundaries might have been the critical factor that gave us an overwhelming advantage -the ability to gather in large crowds and act with a common purpose. Harari thinks "belief" united Homo Sapiens family groups into tribes that then collectively waged war and decimated the indigenous Neanderthals (who were otherwise physically stronger and better adapted to survive in the cold Northern climates of ice age Europe).

Arbitrary beliefs, such as a fantasy that the king was perhaps descended for the Sun, provided the cultural cohesion on a scale around which thousands of citizens could coalesce. Cultural beliefs were thus at the heart of the development of social status in hierarchical social institutions and caste systems that underpinned the smooth running of ancient cities containing tens of thousands of individuals. Harari's hypothesis is important because it explains why belief, not rationality, was the central factor that linked and initiated mankind's sudden "big bang" development that coincided with the emergence of art and the sudden explosion of creativity in tool-making.

Archaeologists have often linked evidence of ritual burial with the emergence of modern man. How about linking the emergence of belief with the emergence of language too? After all language is dependent on the labelling of things and things can only be labelled after we have a capacity to all agree on universal concepts of what things are. Such elemental concepts as greenness and blueness are differences that have to be agreed upon by consensus and then believed in before they can be named. (In many remote cultures there are no words to separate greenness and blueness). The question of what is a stool and what is a table again goes back to consensus and shared ways of looking at things. (A spider would have no reason to differentiate them the way we do)

Arbitrary beliefs, such as a fantasy that the king was perhaps descended for the Sun, provided the cultural cohesion on a scale around which thousands of citizens could coalesce. Cultural beliefs were thus at the heart of the development of social status in hierarchical social institutions and caste systems that underpinned the smooth running of ancient cities containing tens of thousands of individuals. Harari's hypothesis is important because it explains why belief, not rationality, was the central factor that linked and initiated mankind's sudden "big bang" development that coincided with the emergence of art and the sudden explosion of creativity in tool-making.

Archaeologists have often linked evidence of ritual burial with the emergence of modern man. How about linking the emergence of belief with the emergence of language too? After all language is dependent on the labelling of things and things can only be labelled after we have a capacity to all agree on universal concepts of what things are. Such elemental concepts as greenness and blueness are differences that have to be agreed upon by consensus and then believed in before they can be named. (In many remote cultures there are no words to separate greenness and blueness). The question of what is a stool and what is a table again goes back to consensus and shared ways of looking at things. (A spider would have no reason to differentiate them the way we do)

Harari devotes large sections of his books to charting our species progress. His account starts with the transition of family groups of hunter-gatherers into farming communities and ends with predictions about where modern societies with the aeroplanes and mobile phones might be heading. An important message is that progress does not always make society more comfortable and safe. The classic example was the transition from wandering hunter-gatherers into fixed farming communities that heralded in thousands of years of malnourishment and physical hardship. Our belief systems also often get in the way of "progress". The Greek inventions of science and philosophy (literally a love of

Knowledge) could not be utilised for 1500 years because an incoming new religion called Christianity introduced

the retrogressive belief that it was blasphemous to have an inquiring mind. Believers in the church were told that Adam and Eve were thrown out of the Garden of

Eden for eating from the Tree of Knowledge.

The age of Enlightenment and the modern era were preceded by Copernicus (1514) challenging the Church's (God's) doctrine that the Earth was the centre of the universe.

150 year later the hold of the church was so weakened that Newton did not bother to ask God why an apple falls to the ground, instead he asked himself and in 1687 used the word "gravitas" to describe the effect that became known as weight or gravity. Thinkers like Copernicus and Newton demonstrated that mankind's power of reason could overturn the immutable wisdom of the holy

scriptures. Today "knowledge" largely belongs to the domain of Science and Reason which is built on a scaffolding of "facts". Facts are elucidated through our species unique ability to solve problems using language, reason and deduction. Orthodox religions that used to protect the ruling elites of many societies have gradually accepted the new status quo or have been replaced by political institutions that hold the widespread view that it is humanity, through the application of our minds, that should control our destiny. During the Age of Enlightenment God's sacred place was gradually supplanted by new beliefs that elevated our minds as being the most sacred thing on our planet, it is on this fertile ground that modern democracies, which asks citizens to think for themselves, flourished. In Harari's view the 20th century was dominated by a global belief system called Humanism.

The birth of science, Humanism and the Age of Enlightenment were powerful catalysts that guided us away from monotheism into new belief systems. Thoughts of an almighty all-knowing God were gradually replaced with abstract ethereal thought processes which were labelled and given physical presence. A reverence for the sacredness of the individual in control of his or her own destiny produced democratic institutions. Capitalism was created out of the new abstract concepts of money and trade. In capitalist societies the workings of businesses (their staff, transactions, assets and contracts) were forced into virtual containers called limited companies. Ford, Apple and Uber are only possible because we believe their metaphysical presence are entities with legal rights and responsibilities.

Money has undergone similar transformations. For thousands of years gold and bronze tokens were used for storing value, rewarding work and facilitated trade across tribal boundaries. Capitalist society first replaced gold with base metal tokens and paper IOUs. Then one by one central banks dropped the gold standard and made someone's wealth a matter of a few numbers on a bank ledgers. Today, the physical wealth of the world is registered as electronic signals on the silicon chips of computers and internet servers in banks. This journey is far from over. The coming of the internet. social media and new permutations of money are all changing our perceptions of who we are and what we believe in.

In the final chapters of his book Prof Harari makes personal predictions that Capitalism has found a new bedfellow. Humanism, which had supplanted a long period of the monotheism of the Middle Ages, is now itself being replaced by a new set of beliefs that no longer thinks of humans as having sufficient power of knowledge to decide their own destinies. Young people are relinquishing their free will to the superior power of machines with AI that processed data to find out what they want to do with our lives. Harari calls this emerging belief system Dataism

| Apple: Symbol of God's Knowledge (scriptures) or Man's Knowledge (Science)? Image: Waking Times |

The birth of science, Humanism and the Age of Enlightenment were powerful catalysts that guided us away from monotheism into new belief systems. Thoughts of an almighty all-knowing God were gradually replaced with abstract ethereal thought processes which were labelled and given physical presence. A reverence for the sacredness of the individual in control of his or her own destiny produced democratic institutions. Capitalism was created out of the new abstract concepts of money and trade. In capitalist societies the workings of businesses (their staff, transactions, assets and contracts) were forced into virtual containers called limited companies. Ford, Apple and Uber are only possible because we believe their metaphysical presence are entities with legal rights and responsibilities.

Money has undergone similar transformations. For thousands of years gold and bronze tokens were used for storing value, rewarding work and facilitated trade across tribal boundaries. Capitalist society first replaced gold with base metal tokens and paper IOUs. Then one by one central banks dropped the gold standard and made someone's wealth a matter of a few numbers on a bank ledgers. Today, the physical wealth of the world is registered as electronic signals on the silicon chips of computers and internet servers in banks. This journey is far from over. The coming of the internet. social media and new permutations of money are all changing our perceptions of who we are and what we believe in.

In the final chapters of his book Prof Harari makes personal predictions that Capitalism has found a new bedfellow. Humanism, which had supplanted a long period of the monotheism of the Middle Ages, is now itself being replaced by a new set of beliefs that no longer thinks of humans as having sufficient power of knowledge to decide their own destinies. Young people are relinquishing their free will to the superior power of machines with AI that processed data to find out what they want to do with our lives. Harari calls this emerging belief system Dataism

|

| Data-ism pic: techvshuman.com |

Dataism is the giving up of free will to

machines that collect data on us and then use algorithms to guide our choices.

For instance my choice of books to read is greatly influenced by Amazon which

owns a profile of the book reading habits of millions of customers. Using

algorithms and the profiles collected from other customers, Amazon is able to

accurately predict from my buying patterns which books I might like to read next. As I become used to this system I stop

choosing new books by browsing in bookshops or asking friends for their

recommendations and instead rely on Amazon to choose my books for me. In future societies our self-driving cars may include

algorithms that tell us what times and which routes to take to work. Our Fitbits

will measure our health and recommend suitable medications, diets and

exercise regimes. The profiles made about us by machines are extremely accurate predictors. Studies

have shown that the profiles Facebook make from analysing our "likes" are more

predictive about our lifestyle choices and political choices than our closet family, in fact machines

are becoming better at predicting our behaviour than we are ourselves. Young

people are more at home with Dataism than the older generations and are already

willing to place more of their decision making in the hands of machines than

themselves

|

| Image: Lifehacker Australia |

The rise of Dataism coincides with the intrusion of data analysis from social media sites being used in election campaigns. Young people

are giving up privacy and political beliefs and adopting behaviour such as sharing

selfies and data about themselves across a global landscape of social media. Their individuality is being subsumed in a melting pot and global Zeitgeist that is held in data on the Internet.

Perhaps one reason they voted to stay in the EU and rejected the Brexit mantra

about "taking back control" was that they like the way the world works

and want politics to be organised for them and not by them?

A new word that has arrived in the vocabulary of Dataism is Blockchain. Recently I saw a striking statement that there are three developments that are about to change our world of jobs; Robotics, AI and blockchain. To demonstrate how powerful this autonomous data-bending technology is look at the American megastore Wallmart. Wallmart employed IBM to build a blockchain software to create a food-tracing process. The result was that work that previously took six days was reduced to two seconds. Blockchain solutions remove the need for middle management and many white collar jobs will be lost. On the positive side blockchain saves time, reduces errors and distributes power away from the top to all levels of an organisation.

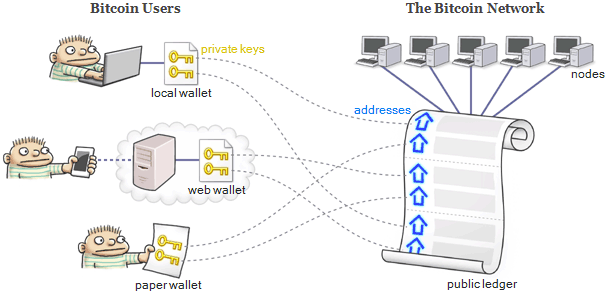

Blockchain's virtue is that it is a secure communal way of handling data. Records are held on a "decentralized dynamic database ledger" that is then stored on multiple servers. The ledger is made up of units (blocks) strung on a thread (chain). Each unit is monitored by validators and nodes that collectively check the arrival of new data on the blocks. The unique feature of blockchain is that once data is updated and validated by the community (nodes) nobody can tamper with it.

Each bit of incoming data has to be agreed upon by the participating nodes before it is accepted and registered on the chain. Once the new data has been validated and registered by the community, it cannot be changed. Many technologists call this "digital immutability." The communal building and validation of the information is so deeply embedded on the blocks that it is impossible to hack or corrupt. Contractual obligations can be put on blockchain, executed, agreed upon, and recorded as data that cannot be tampered with afterwards. These contacts are called "Smart Contracts".

Trust between the community of users of the system dispenses with the need to have a central authority such as a company, legal firm, bank or broker to execute the agreements.

"the most valuable property of blockchains — the ability to reach a shared truth that everyone agrees on without intermediaries or a centralized authority."

The first blockchain was born in 2010, shortly after the banking crisis of 2007, when an idealistic techno-geek who called himself Satoshi Nakamoto used the technology to create a digital currency that needed no banks. The real identity of Satoshi Nakamoto is known to very few people.

Each unit of the block chain was called a Bitcoin. However, unlike our national (fiat) currencies which are managed and issued through banks, Bitcoins have autonomous lives. The eventual number of coins was predetermined by the length of the chain. Nakamoto's chain was 21 million blocks long. Each Bitcoin can be divided into 100,000 smaller bits called Satoshis. (100,000 Satoshis = one Bitcoin).

Nakamoto wanted to distribute his coins across the Bitcoin community so he set up a system where new coins of his currency would be minted one at a time every ten minutes and handed out to the first computer to crack a code. The process of cracking the codes is called called "mining". As the value of Bitcoin has gone up so has the competition to be first to crack the algorithm. This in turn triggers the Bitcoin software to make the codes harder to crack. At first, Bitcoins could be minted on home computers at very little cost. However, as the value increased so did the difficulty of the task, and the electricity bill to mine. In the UK the cost of mining one Bitcoin is about $8,400 dollars, much more expensive than in China where one a coin uses $3,400 worth of electricity. Most Bitcoins are minted in China by four companies set up in rural economies where electricity is very cheap. Bitcoin is often criticised for the amount of electricity that is being used to maintain the system. Collectively miners use more electricity than a countries the size of Argentina or Ireland

Nakamoto's dream has gone wrong; the Bitcoins and control of the operating system have not been

dispersed across the Bitcoin community; 97% of Bitcoin stock is asleep in the

crypto wallets of 4% of the community. The crypto barons are known as "whales" and are hugely rich

on paper and also have a disproportionate and dangerous control over the validating nodes. Furthermore Bitcoin's ground-breaking technology is simply not fast enough

to keep up with even low volumes of transactions. Bitcoin is slow, expensive and impractical for usage by retail websites.

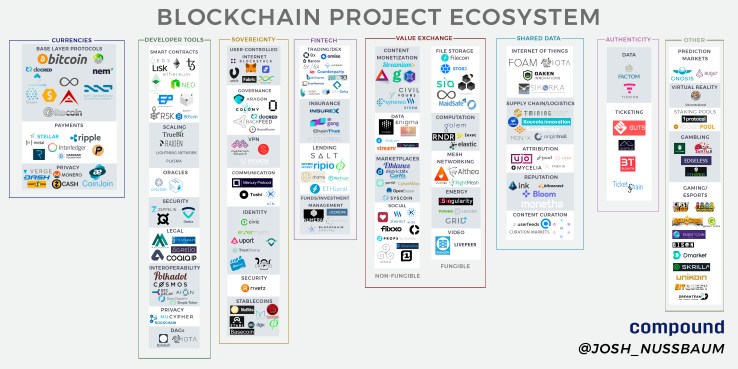

Maybe Nakamoto's experiment failed to create a bank-free people's currency but he did successfully demonstrate how well blockchain can work. This lesson was first understood by the geekish fan base of the early Bitcoin miners and investors many of whom became multi-millionaires. For them Nakamoto's hippy dreams had worked. The fan base created 1,500 new digital tokens with more advanced technological features than Nakamoto's coins. Some digital coins are ideological, many include their own smart functionality. Others are get rich quick scams. Anonymity and secrecy seems to be highly valued by the anti-banking crypto community. An example of a popular new smart currency is Verge. Verge not only encrypts the transaction but also the IP addresses of the senders and receivers making financial transaction invisible. Very few crypto currencies are well- managed businesses with proper business plans. However, they prospered in the corrupt ecosystem of unregulated digital currency exchanges developed by Bitcoin. Many made huge profits from the public and acted as havens for hidden stored wealth, black market payments, money laundering and tax evasion.

In 2017 crypto coinage briefly developed an iconic status following the news of Bitcoin's stratospheric increase in value. In Dec 2017 the unregulated geek exchanges were swamped with hoards of small investors eager to get in on the get rich quick bandwagon. In an interview the CEO of Binance, a Chinese crypto exchange, said they received 250,000 new registrations in one hour. The applicants were largely men aged 25 - 35 flocking into an unregulated wild-west, some were maxing out their credit cards in the expectation of buying their first Lamborghinis. Others brought huge investments of tens of thousands of pounds in the expectation of becoming billionaires.

I never invested in Bitcoin but I witnessed the mayhem on their forums. It was heart rendering to read the deep pain of the small investors after their money had been swallowed by the whales . A student in Morocco told us he had invested all the money he had saved for his education, another young man said he had lost his girlfriend, home and dog. In the newspapers there were reports of numerous suicides in Korea where the crypto mania had hit hardest. All this market manipulation, criminality, environmental degradation by Bitcoin miners and the despair of the duped investors has attracted a negative reaction from the authorities and regulators who are now moving in to control the markets.

There is a growing awareness in the industry that few of 1,500 coins on the unregulated exchanges represent ideas of creative genius and fewer still ever become commercial successes.

In 2012, not long after after Nakamoto launched Bitcoin, a small group of cryptographers set up a Silicon Valley company called Ripple. You will remember that Nakamoto had dispersed the control of the Bitcoin Blockchain by giving

control of the verification nodes to the miners that cracked the codes

that produced the new Bitcoins every ten minutes. Decentralisation was

always a central creed of Nakamoto's fan base. The young executives at Ripple thought that the way the nodes were set up would always hamper the scaling and speed of the blockchain and make Bitcoin unfit for its intended purpose. The first blasphemous decision made by Ripple was to dispose of mining, instead they created a blockchain of a hundred billion units that was owned by the company and controlled by nodes owned by Ripple.

XRP has all of the properties of blockchain except it is a thousand times faster and a 50 times more scalable. It was not decentralised. XRP is also 70,000 times cheaper to use.

Over 2018 Ripple have worked hard to pass control of the default nodes to the control of outside organisations. They claim XRP is now more decentralised than Bitcoin.

Ripple then made a second blasphemous decision, they decided to design their digital currency to be used by banks and financial institutions. Bitcoin had been designed to eliminate banks.

Ripple then made a third blasphemous decision. They decided they would approach regulators and central bankers from around the world and invite them to work with Ripple to make their currency compatible with the regulation of fiat currencies. The Bitcoin fan base wanted to create an autonomous currency that was unregulated by the establishment, especially the banks.

A new word that has arrived in the vocabulary of Dataism is Blockchain. Recently I saw a striking statement that there are three developments that are about to change our world of jobs; Robotics, AI and blockchain. To demonstrate how powerful this autonomous data-bending technology is look at the American megastore Wallmart. Wallmart employed IBM to build a blockchain software to create a food-tracing process. The result was that work that previously took six days was reduced to two seconds. Blockchain solutions remove the need for middle management and many white collar jobs will be lost. On the positive side blockchain saves time, reduces errors and distributes power away from the top to all levels of an organisation.

Blockchain's virtue is that it is a secure communal way of handling data. Records are held on a "decentralized dynamic database ledger" that is then stored on multiple servers. The ledger is made up of units (blocks) strung on a thread (chain). Each unit is monitored by validators and nodes that collectively check the arrival of new data on the blocks. The unique feature of blockchain is that once data is updated and validated by the community (nodes) nobody can tamper with it.

Each bit of incoming data has to be agreed upon by the participating nodes before it is accepted and registered on the chain. Once the new data has been validated and registered by the community, it cannot be changed. Many technologists call this "digital immutability." The communal building and validation of the information is so deeply embedded on the blocks that it is impossible to hack or corrupt. Contractual obligations can be put on blockchain, executed, agreed upon, and recorded as data that cannot be tampered with afterwards. These contacts are called "Smart Contracts".

Trust between the community of users of the system dispenses with the need to have a central authority such as a company, legal firm, bank or broker to execute the agreements.

"the most valuable property of blockchains — the ability to reach a shared truth that everyone agrees on without intermediaries or a centralized authority."

BITCOIN

The first blockchain was born in 2010, shortly after the banking crisis of 2007, when an idealistic techno-geek who called himself Satoshi Nakamoto used the technology to create a digital currency that needed no banks. The real identity of Satoshi Nakamoto is known to very few people.

| Satoshi Nakamoto, the anonymous creator of Bitcoin pic: emchat.net |

Each unit of the block chain was called a Bitcoin. However, unlike our national (fiat) currencies which are managed and issued through banks, Bitcoins have autonomous lives. The eventual number of coins was predetermined by the length of the chain. Nakamoto's chain was 21 million blocks long. Each Bitcoin can be divided into 100,000 smaller bits called Satoshis. (100,000 Satoshis = one Bitcoin).

Nakamoto wanted to distribute his coins across the Bitcoin community so he set up a system where new coins of his currency would be minted one at a time every ten minutes and handed out to the first computer to crack a code. The process of cracking the codes is called called "mining". As the value of Bitcoin has gone up so has the competition to be first to crack the algorithm. This in turn triggers the Bitcoin software to make the codes harder to crack. At first, Bitcoins could be minted on home computers at very little cost. However, as the value increased so did the difficulty of the task, and the electricity bill to mine. In the UK the cost of mining one Bitcoin is about $8,400 dollars, much more expensive than in China where one a coin uses $3,400 worth of electricity. Most Bitcoins are minted in China by four companies set up in rural economies where electricity is very cheap. Bitcoin is often criticised for the amount of electricity that is being used to maintain the system. Collectively miners use more electricity than a countries the size of Argentina or Ireland

| pic CNBC..com |

|

| Bitcoin Mining Factory |

Maybe Nakamoto's experiment failed to create a bank-free people's currency but he did successfully demonstrate how well blockchain can work. This lesson was first understood by the geekish fan base of the early Bitcoin miners and investors many of whom became multi-millionaires. For them Nakamoto's hippy dreams had worked. The fan base created 1,500 new digital tokens with more advanced technological features than Nakamoto's coins. Some digital coins are ideological, many include their own smart functionality. Others are get rich quick scams. Anonymity and secrecy seems to be highly valued by the anti-banking crypto community. An example of a popular new smart currency is Verge. Verge not only encrypts the transaction but also the IP addresses of the senders and receivers making financial transaction invisible. Very few crypto currencies are well- managed businesses with proper business plans. However, they prospered in the corrupt ecosystem of unregulated digital currency exchanges developed by Bitcoin. Many made huge profits from the public and acted as havens for hidden stored wealth, black market payments, money laundering and tax evasion.

In 2017 crypto coinage briefly developed an iconic status following the news of Bitcoin's stratospheric increase in value. In Dec 2017 the unregulated geek exchanges were swamped with hoards of small investors eager to get in on the get rich quick bandwagon. In an interview the CEO of Binance, a Chinese crypto exchange, said they received 250,000 new registrations in one hour. The applicants were largely men aged 25 - 35 flocking into an unregulated wild-west, some were maxing out their credit cards in the expectation of buying their first Lamborghinis. Others brought huge investments of tens of thousands of pounds in the expectation of becoming billionaires.

|

| A crypto-coin band Dec 2017 |

The price of Bitcoin momentarily soared to $20,000 per token before the whales started scooping money out of their unregulated exchanges and crashed the market. On the way down the whales played tricks that on any other exchange would be illegal, pumping and dumping the prices to wash money out of the pockets of small investors and into their accounts. Today a Bitcoin is worth $6,000 and the worst hit "alt" coins have lost up to 97% of their value.

| Befuddled Crypto Investor Picture: Crytocoinnews.com |

There is a growing awareness in the industry that few of 1,500 coins on the unregulated exchanges represent ideas of creative genius and fewer still ever become commercial successes.

RIPPLE'S THREE BLASPHEMOUS DECISIONS

(Important Legal Point: The digital asset (crytocurrency is a layperson's term) promoted and used by Ripple is

called XRP. XRP was not created by Ripple. Several years ago, 95% of the XRP

tokens were gifted to Ripple labs.)

XRP has all of the properties of blockchain except it is a thousand times faster and a 50 times more scalable. It was not decentralised. XRP is also 70,000 times cheaper to use.

Over 2018 Ripple have worked hard to pass control of the default nodes to the control of outside organisations. They claim XRP is now more decentralised than Bitcoin.

Ripple then made a second blasphemous decision, they decided to design their digital currency to be used by banks and financial institutions. Bitcoin had been designed to eliminate banks.

Ripple then made a third blasphemous decision. They decided they would approach regulators and central bankers from around the world and invite them to work with Ripple to make their currency compatible with the regulation of fiat currencies. The Bitcoin fan base wanted to create an autonomous currency that was unregulated by the establishment, especially the banks.

The divide in the crypto community is almost religious and reflects a divide that is happening in society. The hippy dreams of Nakamoto are embedded in a belief in humanistic values and the sanctity of individual privacy. Bitcoin is a reaction against a world that is too readily embracing Datarist values. Ripple are creating a system which works with the current trends, their crypto currency is pro-establishment and transactions on it are fully visible. The flip side is that we might one day regret allowing banks, businesses and the authorities such easy access to collectible data about us.

A sizeable portion of the crypto community, sometimes known as "Bitcoin maximalists", know that XRP is more technically advanced. They can see that once banks adopt XRP, it will become the ".com" of crypto currencies and the natural choice for the general public, institutions and businesses like Amazon, Apple and Microsoft to use. The success of the "banker's coin" (the politest name they use for XRP) thus threatens to suck the Bitcoin community dry. They will do anything to destroy XRP's reputation and prevent its success.

THE RIPPLE DREAM BEGINS TO COME TRUE

Brad Garlinghouse, CEO of Ripple Labs

The Ripple dream is an edifying opportunity for small investors. Brad Garlinghouse, the CEO of Ripple, plans of integrating crypto currencies with the institutions of the real world - a good project with obvious benefits that everyone can believe in. Through the sale of about 30 billion XRP tokens and ownership of another 55 billion XRP, Ripple are already one of the richest companies in the world. They have used this money wisely to build the best tech and best connected management teams, with tentacles that stretch from membership of advisory boards of the IMF, regulatory boards of central banks and Silicon Valley brand names like Google, Uber and Apple.

They have also been making huge multimillion dollar donations to charities and are working with the Bill Gates' Foundation on a project called Mojaloop, which aims to bring mobile banking services to two billion poor people.

Ripples primary focus has always been to make XRP the bridge currency that transports money across borders. They are disrupting SWIFT, a messaging system used by the banks to send money to overseas banks. SWIFT arrange for the money to be paid at the receiver's end from stockpiles of local currency. These piles of money are called Vostro Nostro accounts. It is estimated that banks have 27 trillion dollars doing nothing in Vostro Nostro accounts. The system is akin to sending a letter in the post and not knowing wqhen it will get there, when it will arrive, or whether it will arrive battered and damaged. Sometimes a money transfer will go directly to ita destination. Other times, it goes through a series of correspondence banks that charge transaction fees in transit. There is a 6% error rate.

The Ripple solution is to use XRP as a Bridge Asset. An American bank would buy XRP with Dollars from a local market maker. The XRP then travels over the Ripple network to Japan where it is sold locally for Yen before being delivered into the recipient's bank account. The software takes about 3 seconds and is seamless. The bank staff enter dollars on a screen and the software tells the user the cost of the transaction before before the transaction has started. The recipient sees the yen appear in their bank account three seconds later. It can cost almost nothing to send a million dollars, saving the banks huge amounts of money while at the same time as avoiding errors and saving time.

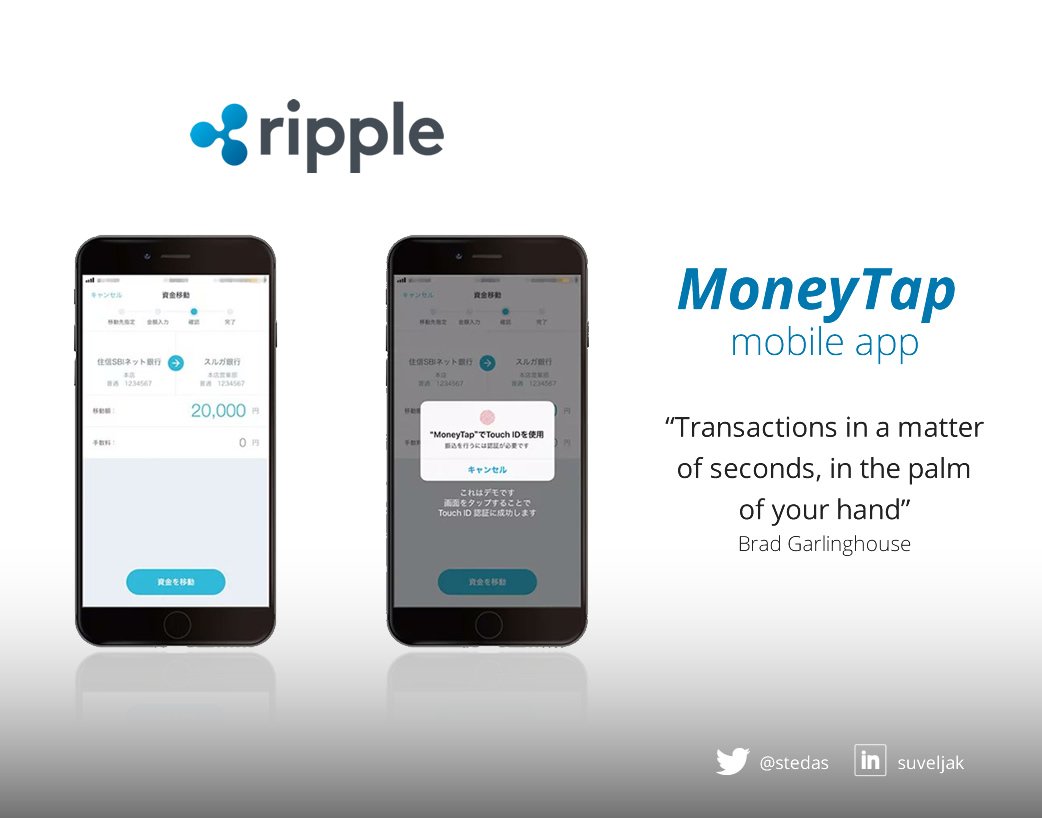

Ripple technology is also being utilised for domestic transfer and payments. This month a Japanese banking consortium called SBI have been rolling out a mobile app called Money Tap that allows users to send money directly from their phone.

Moneytap-like tech would also disrupt the credit card payments through Visa and Mastercard on retail sites like Amazon where there are charges about 3% per transaction. The costs of using digital tech like Moneytap would reduce those charges to less than 1%. Amazon have already expressed an interest in Ripple technology.

It seems inevitable that Moneytap will eventually utilise the cross border payment features of Ripple software, which would allow the user to send money from their phone to recipient, in other countries. This would be hugely popular because a waitress in Japan will be able to send her yen wages to her home in the Philippines at very low cost. The family at the other end would get the payment in Philippine pisos. The very low costs of using digital assets for cross border payments is set to disrupt the services of remittance companies like Western Union and Moneygram, who earn high revenues from migrants sending money home.

THE NEW CRYPTO ECOSYSTEM

XRP is technically far ahead of all other digital assets and the only one that hundreds of banks and Fintech companies have been testing for cross-border payments. Ripple have also developed interlocking modules that meet the diverse needs of banks, fintech and international corporations that want to transfer value on the ILP. 2018 has seen the setting up of dozens of market makers in many countries to handle the buying and selling of XRP in local currencies. Given these competitive and technological advantages took huge amounts of money and years to develop, it seems certain that XRP is the candidate without equal to win the race to become the digital bridging asset that provides liquidity on the ILP.

Some commentators have suggested that if you have digital dollars and digital yen, you do not need a digital bridge currency like Ripple's XRP. This is a misunderstanding, XRP is a unifying basket of value that provides the liquidity that oils and balances the system. XRP is also politically and economically neutral asset that could replace the need for a country's domestic currency to be used as a reserve currency. The post-war Bretton Woods agreement made the US dollar the official reserve currency for pegging the price of commodities like oil. On the surface, this looks very good for America because everyone has an interest in keeping the value of the dollar high and stable. For example, China now owns so many dollars that its economy would crash if the dollar went down in value. The flip side for America is that the dollar valuation is no longer in synch with domestic needs (the Triffin Paradox). The value of the dollar has been overvalued for decades undermining American industries and creating huge trade deficits that are held in check by America's creditors in hostage. Until the invention of crypto currencies, it was almost impossible to think of a way unwind the imbalances and devalue the dollar to make industries competitive again (President Trump's big policy). XRP, and perhaps a UN currency to provide an SDR (Special Drawing Rights) currency, could create the right conditions for this to happen.

The Central Banks of a growing group of countries are hard at work setting up digital currencies for domestic use. Japan are planning a J-Coin which will be a digital Yen. Sweden have announced similar commitments and some small countries like Senegal, Venezuela and Tunisia have already set up digital currencies. It seems inevitable that there will one day be digital pounds, dollars, renminbis, roubles and euros.

Faster, clearer telephone signals;

International calls by satellite replacing cables across oceans;

Mobile phones and multichannel HD televisions

Yesterday's expectations seem banal when compared to what happened in the real world. The changes were unpredictable and happened in a sequence of inspired ideas that dazzled business and enthused the fashion conscious. The biggest leap forward was after digital telecoms made it possible to link computers, from which the internet was born. Within half a decade nearly everyone had an email address and no longer wrote letters. Businesses opened websites to advertise and sell their services.

The rich, young things at the end of 1990s expressed their status by owning an Ipod, a digital camera and "text" messageer. In the 2000s students built private profiles on Facebook and exchanged pictures. Apple combined the features of Ipod and the digital camera onto one handset with a touch sensitive video screen. The new Iphones included something called an App. Apps ignited a flood of addictive services provided from small companies. Back in the 1990s who ever imagined Snapchat, Twitter and Skype?

The impact of GPS and AI on mobile tech was particularly unpredictable. Did you foresee that the combination of mobile tech and GPS would would transform your phone into a visual guide that provided maps with a detailed commentary about which exit to take, the location of speed cameras, road works and traffic jams and accurately telling you when you would arrive? Did you ever imagine a telephone that told you the position of a train delayed down the line and where to find the nearest sushi bar was?

When we think of digital money, we fall into same trap of imagining it is just about modified money and that the big changes will be to make our financial transactions easier, faster and more accurate. Visa and retail payments are already fast. Apple has already added a feature that allows you to swipe your Iphone to pay for something. The digital money revolution seems to us to be a tech revolution that might change a few things under the bonnet but not change our lives. The point I am emphasising here is that the effects of digitalising telecoms were always beyond our imaginings because the new ideas emerge from combining digital datasets together. The same lessen needs to be applied to digital money

So far we have only looked at examples of the obvious application of digital currency, the equivalent of someone in 1990 predicting digital telecoms will make telephone calls clearer, cheaper and more mobile. The really exciting stuff happens when digital crossover happens between the Internet of Value and the Internet of Things (A concept we do not have space to explain but maybe thought of as the internet of intelligent conversation between objects).

For instance as a as a random thought experiment, let us combine intelligent, conversive cars with GPS and micropayments. What sorts of scenarios can we think up?

The unedifying birth of digital currencies has brought their

potential to the notice of banks, financial institutions and regulators who are

getting themselves geared up for the blockchain revolution that will

soon be upon us.

One of the big contributions from Ripple has been the building and gifting of the Inter-ledger Protocol (ILP) This is a platform and hub on which any number of different ledgers and crypto- exchanges can trade. It is open source which means the code and maintenance is no longer Ripple's property and it is maintained communally. All the banks and fintech companies in the world can plug into the ILP to send each other digital assets (crypto-currecncies), it is rapidly being adopted as the universal platform for the "Internet of Value".

XRP is technically far ahead of all other digital assets and the only one that hundreds of banks and Fintech companies have been testing for cross-border payments. Ripple have also developed interlocking modules that meet the diverse needs of banks, fintech and international corporations that want to transfer value on the ILP. 2018 has seen the setting up of dozens of market makers in many countries to handle the buying and selling of XRP in local currencies. Given these competitive and technological advantages took huge amounts of money and years to develop, it seems certain that XRP is the candidate without equal to win the race to become the digital bridging asset that provides liquidity on the ILP.

Some commentators have suggested that if you have digital dollars and digital yen, you do not need a digital bridge currency like Ripple's XRP. This is a misunderstanding, XRP is a unifying basket of value that provides the liquidity that oils and balances the system. XRP is also politically and economically neutral asset that could replace the need for a country's domestic currency to be used as a reserve currency. The post-war Bretton Woods agreement made the US dollar the official reserve currency for pegging the price of commodities like oil. On the surface, this looks very good for America because everyone has an interest in keeping the value of the dollar high and stable. For example, China now owns so many dollars that its economy would crash if the dollar went down in value. The flip side for America is that the dollar valuation is no longer in synch with domestic needs (the Triffin Paradox). The value of the dollar has been overvalued for decades undermining American industries and creating huge trade deficits that are held in check by America's creditors in hostage. Until the invention of crypto currencies, it was almost impossible to think of a way unwind the imbalances and devalue the dollar to make industries competitive again (President Trump's big policy). XRP, and perhaps a UN currency to provide an SDR (Special Drawing Rights) currency, could create the right conditions for this to happen.

The Central Banks of a growing group of countries are hard at work setting up digital currencies for domestic use. Japan are planning a J-Coin which will be a digital Yen. Sweden have announced similar commitments and some small countries like Senegal, Venezuela and Tunisia have already set up digital currencies. It seems inevitable that there will one day be digital pounds, dollars, renminbis, roubles and euros.

WHAT HAPPENS WHEN INDUSTRIES GO DIGITAL

The

first major development that emerged from digital telecoms was the fax machine

(mid 1980's). At that time, we were living in London. By the early 1990s,

satellite dishes were appearing on the façades and rooftops of every

household and the roads around the city were being dug up to lay optical

fibre for "cable tv". Looking into the future we imagined a world

where every household would have multichannel, high definition television

and car phones the size of bricks. Very few of us imagined the digital telecoms revolution that was about to profoundly change our lives. The

futurologists amongst us eagerly awaited

In this section I want to examine the digitalisation

of the telecoms industry and then use this information to imagine how

digital assets might change the way we use money.

Faster, clearer telephone signals;

International calls by satellite replacing cables across oceans;

Mobile phones and multichannel HD televisions

Yesterday's expectations seem banal when compared to what happened in the real world. The changes were unpredictable and happened in a sequence of inspired ideas that dazzled business and enthused the fashion conscious. The biggest leap forward was after digital telecoms made it possible to link computers, from which the internet was born. Within half a decade nearly everyone had an email address and no longer wrote letters. Businesses opened websites to advertise and sell their services.

The rich, young things at the end of 1990s expressed their status by owning an Ipod, a digital camera and "text" messageer. In the 2000s students built private profiles on Facebook and exchanged pictures. Apple combined the features of Ipod and the digital camera onto one handset with a touch sensitive video screen. The new Iphones included something called an App. Apps ignited a flood of addictive services provided from small companies. Back in the 1990s who ever imagined Snapchat, Twitter and Skype?

The impact of GPS and AI on mobile tech was particularly unpredictable. Did you foresee that the combination of mobile tech and GPS would would transform your phone into a visual guide that provided maps with a detailed commentary about which exit to take, the location of speed cameras, road works and traffic jams and accurately telling you when you would arrive? Did you ever imagine a telephone that told you the position of a train delayed down the line and where to find the nearest sushi bar was?

When we think of digital money, we fall into same trap of imagining it is just about modified money and that the big changes will be to make our financial transactions easier, faster and more accurate. Visa and retail payments are already fast. Apple has already added a feature that allows you to swipe your Iphone to pay for something. The digital money revolution seems to us to be a tech revolution that might change a few things under the bonnet but not change our lives. The point I am emphasising here is that the effects of digitalising telecoms were always beyond our imaginings because the new ideas emerge from combining digital datasets together. The same lessen needs to be applied to digital money

So far we have only looked at examples of the obvious application of digital currency, the equivalent of someone in 1990 predicting digital telecoms will make telephone calls clearer, cheaper and more mobile. The really exciting stuff happens when digital crossover happens between the Internet of Value and the Internet of Things (A concept we do not have space to explain but maybe thought of as the internet of intelligent conversation between objects).

The Internet of Things (A concept not discussed in this post)

pic: mayanet.over

How will buying a car look in the future? Maybe it will be more like buying a mobile phone today. You might "buy" from the Toyota network by signing a smart contract. The car of your choice will be sent to your door. There will be a standing charge per week and the contract includes a milage allowance, insurance and maintenance. When you take your car out the car monitors your routes and calculates your journey and charges you fifty cents a mile on the motorway. Then you take some back roads and are charged sixty cents a mile and finally you go into a town where you are charged seventy-five cents an hour. The following week, you plan a holiday with your children and you need a car with more luggage space. Toyota deliver a larger car for the tens days you will be travelling from London to Rome. They suggest the economic route and times of travel and calculate from your profile the hotels you are likely to be able to afford and like. They even use your profile to suggest entertainment stop-offs with "Toyota Member Special Offers" on route to Rome. Everything is calculated and budgeted for you so there will be no surprises when you receive an itemised statement of all your expenditure at the end of your holiday. On your return, you find your usual car clean and serviced. The GPS has already notified Toyota of your return and someone has been sent to collect your holiday car from your home.

How will trade look in future? A business woman ordering ceramic hand-finished tiles from a company in Portugal that she has never done business with before. They do not know each other so the Portuguese company insists she pays in advance. However, she does not want to pay before she sees the quality of the product. They set up a smart contract. The business lady has pre-paid the money in advance into an escrow account, the Portuguese company makes the tiles, and loads them on a container that arrives in port at Southampton. The business lady goes to the port where the port authorities allow you to inspect the tiles and she agree they are as ordered. Before releasing the goods, the Port Authority press the button telling the Portuguese company that the goods have been inspected and this releases her payment into the makers account.

It will not surprise you to know that Ripple are already preparing to be ahead of the game in funding novel futuristic applications for XRP. Top executives have left Ripple to set up Coil which is part funded with Ripple money and will be an umbrella for developing innovative uses for XRP. They already have dozens of projects.

One of the projects is an application that provides websites and blogs with facilities to make micro-payments collections from readers. For instance a news or video site might remove all advertising and instead charge their readers a small micro-fee every time they log on and download a video or news article. No doubt there will be hundred of such ideas. Some will find a market; others will flop into oblivion

Xpring is a new initiative whereby Ripple will invest in, incubate,

acquire and provide grants to companies and projects run by proven

entrepreneurs. Every entrepreneur will use the digital asset XRP and the

XRP Ledger (the open-sourced, decentralized technology behind XRP) to

solve their customers’ problems in a transformative way.

Ripple's plans to catch a stake of every International Payment, Stock & Derivative Transaction, Micropayment and Smart Contract could so easily become monopolistic. If they succeed XRP will become "The" digital bridge and reserve currency of the world and through their ownership of over 50% of the XRP tokens, their company will become by far the richest enterprise to have come out of Silicon Valley. The good news is that so far the management of Ripple have shown themselves to be far sighted and humane.

At the beginning of this article, I wrote of Harari's bleak predictions that the Dataists are coming and that their addictive methods will entice you to give up your free will in exchange for an easier lifestyle. By its nature, blockchain will eliminate many clerical jobs of the middle earning middle classes but through projects like Mojoloop there is also the possibility of much wider dispersal of Value. There will also be new businesses to set up and run.

Many people will continue to complain that the politics, entertainment, news coverage have been dumbed down and it was so much better in the old days. When you randomly turn on the television, listen to the politicians or flick through the newspapers on the news stands, it seems that they are right. What many of these people fail to acknowledge is that if you seek out quality, you will find that the world has never been a safer, richer more rewarding safer place to live in. We are not victims- we are very lucky to be here to partake in this time of rapid change. After all our worlds are what we make of life's opportunities.

FINAL THOUGHTS

The forces that shape the world of the

future will always be out of our control and we cannot even guess

what profound impacts the Internet of Things (a concept we have not discussed) and The Internet of Value will have on our lifestyles.Ripple's plans to catch a stake of every International Payment, Stock & Derivative Transaction, Micropayment and Smart Contract could so easily become monopolistic. If they succeed XRP will become "The" digital bridge and reserve currency of the world and through their ownership of over 50% of the XRP tokens, their company will become by far the richest enterprise to have come out of Silicon Valley. The good news is that so far the management of Ripple have shown themselves to be far sighted and humane.

At the beginning of this article, I wrote of Harari's bleak predictions that the Dataists are coming and that their addictive methods will entice you to give up your free will in exchange for an easier lifestyle. By its nature, blockchain will eliminate many clerical jobs of the middle earning middle classes but through projects like Mojoloop there is also the possibility of much wider dispersal of Value. There will also be new businesses to set up and run.

Many people will continue to complain that the politics, entertainment, news coverage have been dumbed down and it was so much better in the old days. When you randomly turn on the television, listen to the politicians or flick through the newspapers on the news stands, it seems that they are right. What many of these people fail to acknowledge is that if you seek out quality, you will find that the world has never been a safer, richer more rewarding safer place to live in. We are not victims- we are very lucky to be here to partake in this time of rapid change. After all our worlds are what we make of life's opportunities.

The World is Your Oyster

DISCLAIMER

I wrote this article in response to suggestions from the XRP community that I should contribute a blog post giving my eccentric perspective. I have bought some XRP and have a financial interest in the success of XRP which has lost 95% of its value since Jan 2018 and were selling for 30 cents at time of posting, they have now recovered to more like 60 cents. I am not giving you financial advice to buy xrp

Below I have given some links to sites used by XRP community. I suggest that you look at the information before buying XRP.

THE XRP COMMUNITY

Ripple Labs Official Website - https://ripple.com/

XRPchat.com - The Leading XRP Blog

XRP Community Blog - Very important selection of writers publish here https - Pay special attention to post be Hodor, JC Collins and Galgatron https://xrpcommunity.blog/

BUYING XRP

There are a growing number of places where you can buy XRP using a credit card - I use Etoro.com : https://etoro.tw/2LKrSUA (I would get an introductory bonus if you used my link)

REFERENCES

Bitcoin Mining in China Ihttps://www.theguardian.com/technology/2017/nov/27/bitcoin-mining-consumes-electricity-ireland

Central Bank Digital Currencies https://theblockchainland.com/2018/08/31/countries-with-their-own-digital-currencies/

XRP by Numbers https://xrphodor.wordpress.com/2018/01/15/xrp-by-the-numbers-2018-benchmarks/

XRP - how it works https://xrphodor.wordpress.com/2018/01/11/tokens-trust-on-the-xrp-ledger/amp/?__twitter_impression=true

The ILP https://ripple.com/insights/implementing-the-interledger-protocol/

https://ripple.com/

https://ripplenews.tech/

A ripple Analysis https://medium.com/tbis-weekly-bits/i-see-you-xrp-fcf151feb96d

4% OWN 97% OF BITCOIN AS A STORE FOR WEALTH http://uk.businessinsider.com/bitcoin-97-are-held-by-4-of-addresses-2018-1?r=US&IR=T